Need to get your credit score up? Don’t pay anyone to do it–its probably a scam! There may be a very simple way for you to increase your score staring right at you on your credit reports: your balances.

This may not apply to some people, but for anyone with revolving accounts (credit cards or store cards), your score may be hurting (and badly!) because of these accounts. Why? The balances. Often I hear people talking about things like “debt to income” when it comes to credit scores. Your debt to income ratio has absolutely no impact or effect on your credit score. None. What does, however, is your balance to limit ratio, which can have a huge effect on your credit score.

Your balance to limit ratio applies to your revolving accounts and it refers to how much you owe and how much your credit limit is. It is a percentage calculated like this:

balance owed (reported) ÷ credit limit =

So if have a Visa card with a $1,000 limit and you owe $300 on it, it would be 300/1000 = 0.30. And 0.30 is, of course, 30%. This percentage is calculated for each of your revolving accounts.

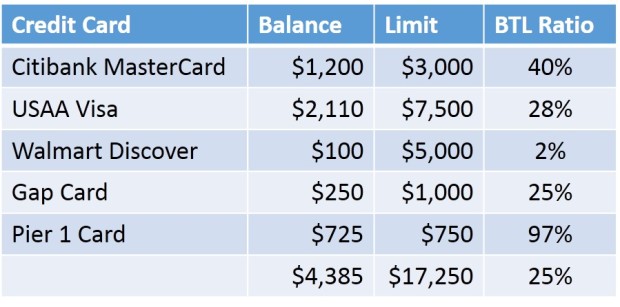

In addition, the scoring software looks at the total amount of credit made available to you compared with the total amount of credit you have used. Here’s an example – on the table below, the individual has 3 major credit cards and 2 store cards.

So, the person above has a total credit card debt of $4,385. The banks have extended him credit though of $17, 250; overall, he has used about 25% of his total credit available. This is not bad – remember: credit scores ideally want to see this ratio at under 20%. And the farther under 20% the better – basically, the best credit scores come from lots of available credit and little to no balances. I have seen plenty of people with solid payment history – 2 or more years even of never missing a payment – and still have a score in the low 600s. The BTL is quite often why. So how do you quickly stop this from hurting your score?

Well, the obvious response is to pay down the balances. You may not have $4,000 lying around though, so you come up with a strategy to maximize the impact based on the amount of money you have. And you start with correcting the problem from the other side. Lowering the balance will lower the BTL. So too will increasing the limit. Call your credit card company and ask for a credit limit increase. In the table above, raising the Citibank limit from $3,000 to $5,000 brings the BTL on that account from 40% to 28% without a single dollar paid. NOTE: Requesting a credit limit increase may or may not result in a hard credit inquiry. If the reason you are working to get your credit score up is for a mortgage, for example, you should find out if your creditors will do increases without a hard inquiry.

As for paying on the balances, I would target one balance in particular first: the Pier 1 card. As is often the case with low-limit credit cards, the balance of $725 is not very high but because of it being just $25 shy of the credit limit it is hurting. That individual account, because it has less than 10% of the credit limit available, is dinging the credit that way as well. Try to get the limits on your store cards raised if possible.

Pay down the balances. Determine your statement cut date – one day before the statement cuts is your last day to pay the balance as low as possible.